Carbon Credit Price Analysis Market Trends and Insights

In this article, we will explore the factors influencing carbon credit prices, examine the latest market trends, and provide valuable insights for businesses navigating this evolving landscape. Understanding the nuances of carbon credit price fluctuations is crucial for organizations seeking to manage their carbon emissions effectively and contribute to a sustainable future.

Join us as we unravel the complexities of carbon credit prices, highlighting its significance and the implications it holds for businesses across various industries.

Understanding Carbon Credit Market

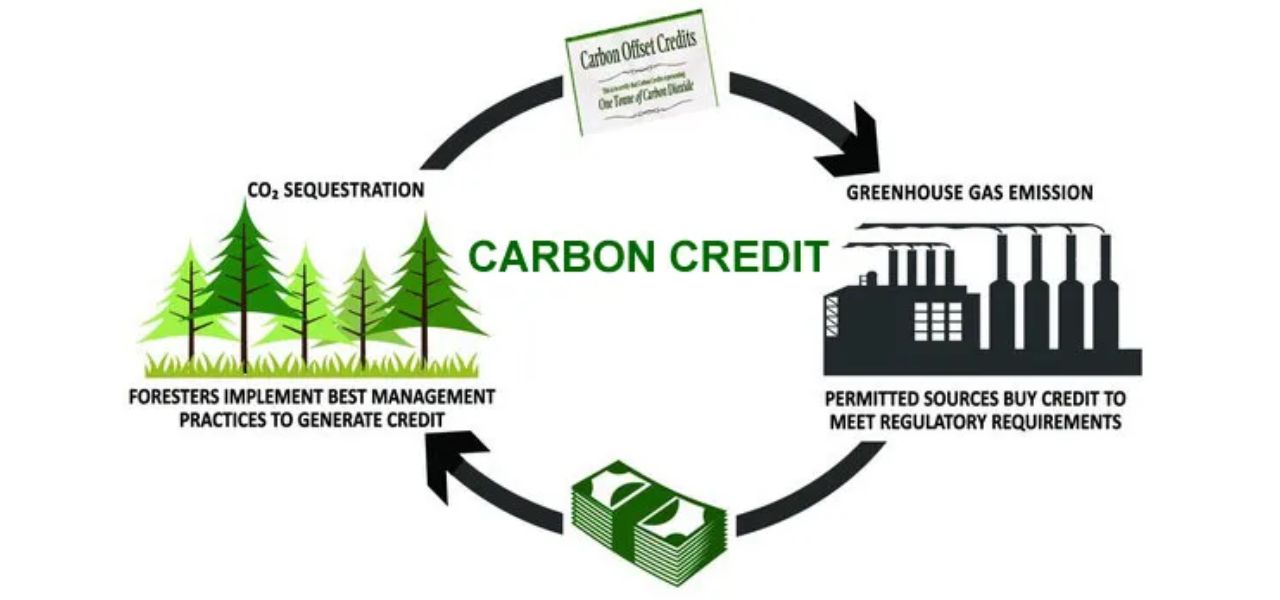

The carbon credit market plays a crucial role in the global efforts to combat climate change. It provides a mechanism for businesses and organizations to offset their carbon emissions by investing in projects that reduce greenhouse gas emissions. To gain a better understanding of the carbon credit market, it is important to examine its key components, including an overview of the market, the factors that influence carbon credit prices, and the key players involved.

The carbon credit market is a platform where carbon credits are bought and sold. Carbon credits represent a quantified reduction in greenhouse gas emissions and are typically measured in metric tons of carbon dioxide equivalent (CO2e). These credits are generated through projects that promote clean energy, energy efficiency, and carbon sequestration. The market operates on the principle of supply and demand, with the price of carbon credits being determined by market forces.

Several factors influence carbon credit prices. First, the regulatory environment and government policies play a significant role. Countries or regions that have established mandatory emissions reduction targets or cap-and-trade systems can create a demand for carbon credits, thereby influencing prices.

Additionally, market conditions, such as the overall level of demand and the availability of carbon credits, can also impact prices. Other factors include the quality and credibility of the carbon credits, as well as the project type and location.

In the carbon credit market, various entities participate as key players. These include project developers, who initiate and implement projects that generate carbon credits. They are responsible for ensuring the projects meet specific criteria and are eligible for carbon credits.

Carbon credit aggregators and brokers act as intermediaries, facilitating the buying and selling of carbon credits between project developers and buyers. Buyers can include businesses, governments, and individuals looking to offset their emissions. Verification and certification bodies play a crucial role in assessing and validating the authenticity and quality of carbon credits.

Understanding the carbon credit market is essential for businesses and organizations looking to offset their carbon emissions. By comprehending the market dynamics, including the factors that influence carbon credit prices and the key players involved, businesses can make informed decisions about their carbon offsetting strategies. This knowledge enables them to navigate the market effectively and identify opportunities for cost-effective carbon credit investments.

Market Trends and Analysis

Historical Carbon Credit Price Trends

The historical analysis of carbon credit prices reveals a fascinating trajectory. In the early years, carbon credits were relatively low in price as the market was still developing and supply was abundant. However, as the demand for carbon credits increased and emissions reduction targets became more stringent, the prices began to rise. This trend highlights the growing recognition of the value and importance of reducing carbon emissions.

Factors Driving Price Fluctuations

Several factors play a significant role in driving price fluctuations in the carbon credit market. One key factor is the supply and demand dynamics. When the supply of carbon credits is limited, either due to regulatory restrictions or reduced availability of emission reduction projects, the prices tend to rise. On the other hand, if the supply exceeds the demand, prices may experience downward pressure.

Policy changes and regulatory frameworks also heavily influence carbon credit prices. Updates to emissions trading schemes, the introduction of new regulations, or changes in government policies can create significant shifts in market dynamics and impact prices. Additionally, global events such as international climate agreements or geopolitical factors can influence market sentiment and subsequently affect carbon credit prices.

Regional Variations in Carbon Credit Prices

Carbon credit prices can vary across regions due to several factors, including differences in emissions reduction targets, regulatory frameworks, and market maturity. Regions with more ambitious emissions reduction goals and stringent regulations may experience higher carbon credit prices as the demand for credits outpaces the available supply. In contrast, regions with less stringent regulations or a surplus of carbon credits may witness lower prices.

It is important for businesses operating in multiple regions or considering carbon credit investments to be aware of these regional variations. Understanding the dynamics of each market can help businesses make informed decisions regarding their carbon credit strategies and investments.

By closely monitoring historical carbon credit price trends, analyzing the drivers behind price fluctuations, and staying updated on regional variations, businesses can navigate the carbon credit market more effectively. This knowledge can assist businesses in developing proactive strategies to manage their carbon credit costs, seize opportunities, and contribute to a more sustainable future.

Insights for Businesses

The price of carbon credits plays a significant role in shaping the sustainability strategies and financial decisions of businesses. Understanding the implications of carbon credit prices is crucial for organizations aiming to offset their emissions and demonstrate environmental responsibility. Here are some key insights for businesses:

Implications of Carbon Credit Prices:

Carbon credit prices directly impact the cost-effectiveness of emissions reduction initiatives. Higher prices can increase the financial burden on businesses, especially those with large carbon footprints. It becomes essential for companies to assess the potential impact of carbon credit prices on their operations and financial performance.

Strategies for Managing Carbon Credit Costs:

To effectively manage carbon credit costs, businesses can adopt several strategies. Firstly, implementing energy efficiency measures and adopting cleaner technologies can help reduce emissions, thereby lowering the need for purchasing additional carbon credits.

Secondly, investing in renewable energy projects or carbon offset projects internally can create a revenue stream through the generation of carbon credits. Additionally, companies can engage in carbon credit trading to leverage market dynamics and optimize their carbon credit portfolio.

Another newest way is switching to carbon negative materials. For example, recently in the plastic industry, plant-based plastic replacing traditional plastic with plant-based alternatives is used as an effective way to cut off carbon emission through the whole supply chain.

Especially at AirX, the world's first manufacturer of carbon-negative materials made from coffee, plant-based plastic is made from agriculture by-products which utilizes agriculture by-products that would otherwise contribute to waste management issues and nvironmental impact.

Leveraging Carbon Credits for Environmental and Financial Benefits:

Businesses can explore opportunities to invest in carbon credit projects that align with their values and goals. By supporting projects that promote renewable energy, reforestation, or community-based sustainability initiatives, companies can contribute to broader environmental benefits while also generating financial returns through the sale of carbon credits.

By carefully assessing the implications of carbon credit prices, implementing effective cost management strategies, and leveraging case studies of successful carbon credit utilization, businesses can navigate the carbon credit market to achieve both environmental and financial benefits. The inclusion of innovative solutions like plant-based plastic further enhances their sustainability efforts and strengthens their position as responsible corporate citizens.

>>> Learn more: Buying Carbon Credits A Guide for Businesses Committed to Climate Action

Contact us

AirX is the world's first carbon-negative bio-material made from coffee grounds manufacturer.

We specialize in producing bio-based composites using recycled carbohydrates derived from by-products such as coffee grounds, coconut husk, husk, and bamboo. Our goal is to promote sustainability through the use of eco-friendly materials.

We are always here to help and provide the best service possible. If you have any questions or would like to receive advice and feedback directly from our sales staff, please do not hesitate to contact us. You can reach us through:

- Whatsapp: +84 969 742 950

- Email: [email protected]

We look forward to hearing from you!